This article introduces recently IPO-listed companies in Japan while highlighting key challenges, business opportunities, industry trends, and unique business models in the Japanese market.

Trial Holdings, headquartered in Fukuoka, Japan, operates a nationwide chain of discount retail stores under the concept of “Your Everyday Essentials Store.” The company combines physical retail with proprietary retail technologies to create smart shopping experiences while optimizing store operations.

While Japan’s retail sector faces rising costs and shifting consumer behaviors, Trial leverages data and in-store technologies—such as smart carts with built-in payment functions and digital signage—to improve convenience, reduce checkout times, and gather customer insights. Its dual focus on affordability and digital transformation positions Trial as a leader in next-generation retail.

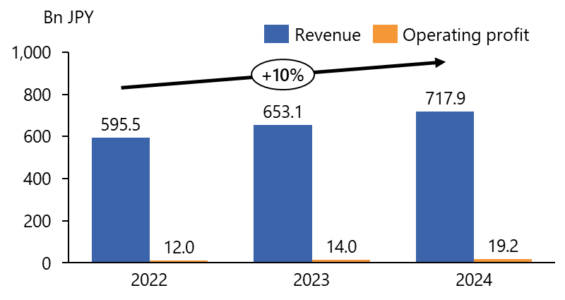

In FY2024, Trial achieved record-high consolidated revenue of ¥717.9 billion and net income of ¥11.4 billion, driven by strong same-store sales, strategic new store openings, and operational efficiencies. The company also successfully listed on the Tokyo Stock Exchange Growth Market in March 2024, strengthening its financial base.

| Company Name | Trial Holdings, Inc. |

| Headquarters | 1-12-2 Tanotsu, Higashi-ku, Fukuoka City, Fukuoka Prefecture |

| Website | https://trial-holdings.inc/ |

| Year of Establishment | 2015/9/18 |

| Listing Date | 2024/3/21 |

| Industry | Retail |

| Business Overview | Planning, management, and operation of a group of companies (pure holding company) focused on various businesses, including retail, logistics, finance/payment, and retail tech. |

| Representative (CEO) | Koichi Kameda |

| Number of Employees | 72 (as of 2023/12/31) |

| Stock Exchange | Tokyo Stock Exchange Growth |

| Auditor | PwC Japan |

| Lead Underwriter | Daiwa Securities / Mitsubishi UFJ Morgan Stanley Securities |

| Market capitalization (at opening price) | 263,342 million yen |

| PER (at opening price) | 26.72 |

| Major shareholders (Top 3) | •T.H.C. Corporation (66.52%) •Heroic investment (9.45%) •Hisao Nagata (1.98%) |

This document has been prepared based on information available at the time of the research. While we strive for accuracy, we do not guarantee the completeness or correctness of the information provided. This document is for informational purposes only and does not constitute investment advice or a recommendation. Readers are encouraged to conduct their own verification and due diligence before making any decisions.

Source: Tokyo IPO, Official Website, Yahoo! Finance