This article introduces recently IPO-listed companies in Japan while highlighting key challenges, business opportunities, industry trends, and unique business models in the Japanese market.

Thinca Co., Ltd., headquartered in Tokyo, Japan, is a technology company dedicated to transforming business communication through cloud-based services. Since its founding in 2014, Thinca has sought to eliminate inefficiencies in communication by developing accessible and user-friendly solutions that empower both businesses and employees across industries.

At the core of Thinca’s offerings is “KAIKURA”, an AI-powered integrated communication platform designed to centralize and visualize all customer interactions. Built around a proprietary cloud CTI (Computer Telephony Integration), KAIKURA links phone, SMS, email, video calls, and other channels into a unified system, automatically associating communication history with customer data and enabling efficient, consistent, and personalized service across teams.

KAIKURA addresses long-standing challenges in analog communications—especially in sectors where telephones remain central to customer engagement, such as real estate, automotive, medical, and small businesses. By integrating with existing phone environments without requiring major infrastructure changes, KAIKURA uniquely bridges the gap between traditional telephony and modern digital communication.

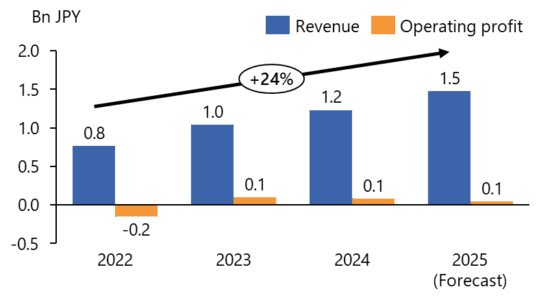

As of FY2024, Thinca achieved:

Looking ahead to FY2025, Thinca forecasts:

By positioning itself as a trusted partner in business communication, Thinca aims to eliminate unnecessary communication burdens, reduce labor through automation, and foster more enjoyable and effective human interactions—making business, and life, more interesting through IT.

| Company Name | Thinca Corporation |

| Headquarters | 3-3, Kanda Nishiki-cho, Chiyoda-ku, Tokyo |

| Website | https://www.thinca.co.jp/ |

| Year of Establishment | 2014/1/8 |

| Listing Date | 2024/3/27 |

| Industry | Information and communication industry |

| Business Overview | Development, sales and other related operations for the communication platform “Kaikura” |

| Representative (CEO) | Takahiro Ejiri |

| Number of Employees | 56 (as of 2024/1/31) |

| Stock Exchange | Tokyo Stock Exchange Growth |

| Auditor | Taiyo |

| Lead Underwriter | SMBC Nikko Securities |

| Market capitalization (at opening price) | 5,279 million yen |

| PER (at opening price) | -33.05 |

| Major shareholders (Top 3) | •Takahiro Ejiri (17.20%) •DCI Venture Growth Support LPS (16.72%) •Nandi Corporation (9.08%) |

This document has been prepared based on information available at the time of the research. While we strive for accuracy, we do not guarantee the completeness or correctness of the information provided. This document is for informational purposes only and does not constitute investment advice or a recommendation. Readers are encouraged to conduct their own verification and due diligence before making any decisions.

Source: Tokyo IPO, Official Website, Yahoo! Finance