This article introduces recently IPO-listed companies in Japan while highlighting key challenges, business opportunities, industry trends, and unique business models in the Japanese market.

Caulis Inc., headquartered in Tokyo, Japan, is a cybersecurity company that develops and provides SaaS-based fraud detection services for financial institutions. Founded in 2015, the company aims to co-create secure information infrastructure and enhance national security by building a database that enables clients to share information on fraudulent users.

Caulis’s flagship product, “Fraud Alert”, is a cloud-based platform designed to detect and prevent cyber threats such as money laundering and unauthorized access. The service enables real-time monitoring of user behaviors across financial transactions—such as account logins, money transfers, and account openings—using device fingerprinting and risk-based analytics. Financial institutions can share blacklisted device data via a centralized system, effectively identifying and halting suspicious activity across organizations. Fraud Alert has been adopted by banks, securities firms, and credit institutions, and is compliant with Japanese laws including the Act on Prevention of Transfer of Criminal Proceeds.

In 2024, Caulis launched new features such as real-time transaction monitoring and electric utility data verification services aimed at identifying fraudulent accounts using inactive or fake addresses. This innovation followed successful pilot programs with power companies and under regulatory frameworks like the Regulatory Sandbox and the Grey Zone Elimination System.

Against the backdrop of rapidly evolving cybercrime methods and growing regulatory requirements (e.g., FATF’s fifth evaluation in 2028), Caulis’s services are increasingly essential. Their platform has helped detect and block nearly ¥1 billion in fraudulent transfers and money laundering attempts in 2024 alone.

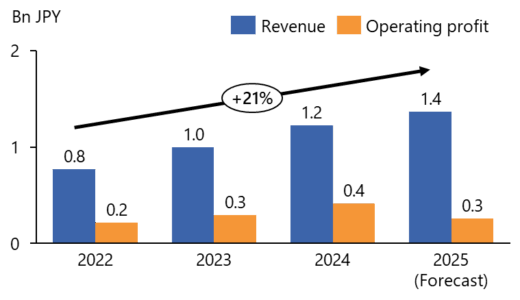

As of FY2024, Caulis achieved revenue of ¥1.225 billion, a 23.1% year-over-year increase, with an operating profit of ¥412 million and an operating margin of 33.7%. The company maintains a high recurring revenue ratio of 94.1%, with an ARR of ¥1.26 billion and an average monthly ARPU of ¥2.24 million. Client retention remains strong, with virtually zero churn in Q4.

For FY2025, Caulis projects revenue of ¥1.37 billion, reflecting 11.8% growth, and plans to invest in R&D, AML talent acquisition, and expansion of its electric data services. Although operating profit is forecast to temporarily decrease to ¥258 million due to upfront investments, these efforts aim to capture mid- to long-term demand—particularly among regional banks—leading up to the 2028 FATF review.

Looking forward, Caulis is committed to further innovation through public-private partnerships, proprietary data utilization, and expansion beyond the financial sector. By offering data-driven, government-aligned compliance solutions, Caulis continues to evolve as a critical infrastructure provider in the fight against cyber-enabled financial crime.

| Company Name | CAULIS Inc. |

| Headquarters | 6-1, Otemachi 1-chome, Chiyoda-ku, Tokyo, Otemachi Bldg. 4F FINOLAB |

| Website | https://caulis.jp/ |

| Year of Establishment | 2015/12/4 |

| Listing Date | 2024/3/28 |

| Industry | Information and communication industry |

| Business Overview | Provide cloud-based intrusion detection services for businesses |

| Representative (CEO) | Atsuyoshi Shimazu |

| Number of Employees | 43 (as of 2024/1/31) |

| Stock Exchange | Tokyo Stock Exchange Growth |

| Auditor | EY |

| Lead Underwriter | SBI Securities |

| Market capitalization (at opening price) | 17,499 million yen |

| PER (at opening price) | 73.03 |

| Major shareholders (Top 3) | •rhizome Corporation (50.14%) •Atsuyoshi Shimazu (8.88%) •Hironori Zoda (4.61%) |

This document has been prepared based on information available at the time of the research. While we strive for accuracy, we do not guarantee the completeness or correctness of the information provided. This document is for informational purposes only and does not constitute investment advice or a recommendation. Readers are encouraged to conduct their own verification and due diligence before making any decisions.

Source: Tokyo IPO, Official Website, Yahoo! Finance