This article introduces recently IPO-listed companies in Japan while highlighting key challenges, business opportunities, industry trends, and unique business models in the Japanese market.

Columbia Works Inc., headquartered in Shibuya, Tokyo, is a theme-based real estate development company committed to creating spaces where individuals can live as the protagonists of their own lives. Since its founding in 2013, the company has pursued an innovative urban development model called “Unicubation”—a fusion of uniqueness and incubation—to revitalize imagination and experience in the built environment.

Columbia Works operates under a single business segment: Real Estate Development, which integrates multiple services under its vertically integrated group structure:

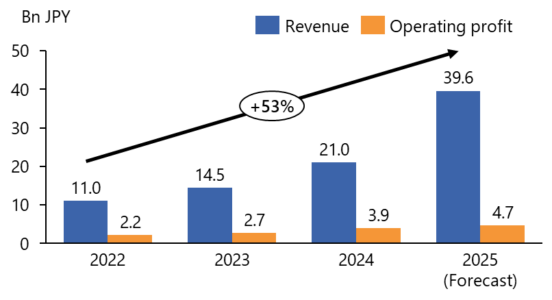

As of FY2024 (ended December 31, 2024), the company reported consolidated revenue of ¥20.98 billion (+45.0% YoY), with ordinary profit of ¥3.89 billion (+43.2% YoY). The company listed on the Tokyo Stock Exchange Standard Market in March 2024.

Columbia Works’ strategy emphasizes diversified development schemes, including direct development, fund-based SPC models, and value-add renovations. The company also explores Build-to-Suit projects tailored to specific tenant needs, such as private health screening centers and international student dormitories.

Looking ahead, Columbia Works aims to deepen its theme-based development approach, integrating services into architecture to enhance Quality of Life (QoL) and stimulate social interaction. By embedding lifestyle experiences—such as fitness, wellness, education, and sustainability—into urban design, the company seeks to redefine the role of real estate in society.

| Company Name | Columbia Works, Inc. |

| Headquarters | 3-28-15 Shibuya, Shibuya-ku, Tokyo |

| Website | https://columbiaworks.jp |

| Year of Establishment | 2013/5/14 |

| Listing Date | 2024/3/27 |

| Industry | Real estate business |

| Business Overview | Operates in a single segment focused on real estate development, leasing, and hotel management. |

| Representative (CEO) | Hitoshi Nakauchi |

| Number of Employees | 32 (as of 2024/1/31) |

| Stock Exchange | Tokyo Stock Exchange Standard |

| Auditor | Futaba |

| Lead Underwriter | Nomura Securities |

| Market capitalization (at opening price) | 12,484 million yen |

| PER (at opening price) | 7.97 |

| Major shareholders (Top 3) | •Nstyle Corporation (52.00%) •Hitoshi Nakauchi (41.40%) •Naoya Mizyama (6.60%) |

This document has been prepared based on information available at the time of the research. While we strive for accuracy, we do not guarantee the completeness or correctness of the information provided. This document is for informational purposes only and does not constitute investment advice or a recommendation. Readers are encouraged to conduct their own verification and due diligence before making any decisions.

Source: Tokyo IPO, Official Website, Yahoo! Finance