This article introduces recently IPO-listed companies in Japan while highlighting key challenges, business opportunities, industry trends, and unique business models in the Japanese market.

HATCH WORK Co., Ltd., headquartered in Tokyo, Japan, is a digital infrastructure company committed to transforming traditional real estate operations through mobility-focused DX (digital transformation) solutions. Since its founding, the company has leveraged cloud technologies to streamline the management and utilization of monthly parking spaces and urban building facilities.

HATCH WORK operates two core businesses:

・Monthly Parking Innovation, centered on “At Parking Cloud”, a proprietary SaaS platform for digitalizing the management of monthly parking lots; and

・Building Innovation, which operates shared conference room and rental office services under the brand “At Business Center”.

In a market where the need for more efficient urban mobility infrastructure is rising, HATCH WORK provides real estate companies and parking lot operators with a full suite of tools for online contract processing, automated payments, delinquency guarantees, and digital customer engagement. As of FY2024, the number of monthly parking spaces registered on At Parking Cloud reached 374,000 (+20% YoY), with 150,000 spaces utilizing payment processing (+26.4%) and 65,000 covered by delinquency guarantees (+41.6%).

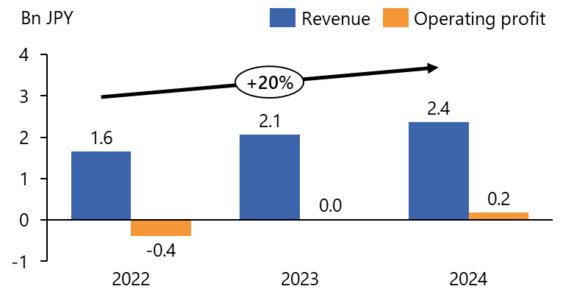

HATCH WORK’s business model is largely subscription- and transaction-based. As of FY2024 (ended December 31, 2024), the company recorded consolidated revenue of ¥2.367 billion (+15.1% YoY), with ordinary profit growing significantly to ¥155 million (+1,224.2% YoY), supported by strong growth in recurring revenue from At Parking Cloud.

Despite underperformance in the Building Innovation segment in the first half, demand recovered to pre-pandemic levels in the second half. The company also booked a ¥21 million impairment loss on certain conference room assets and adjusted deferred tax assets due to increased investment planning, resulting in net income of ¥130 million (+68.2% YoY).

For FY2025, HATCH WORK forecasts consolidated revenue of ¥2.74 billion (+15.8% YoY) and ordinary profit of ¥197 million (+27.5%). Growth is expected to come from continued expansion of At Parking Cloud services, enhanced monetization of underutilized parking lots through short-term rentals (e.g., “At Parking Weekly”), and a strategic alliance with the National Federation of Real Estate Transaction Associations (Hato-mark Support Mechanism), granting access to 100,000 member real estate firms.

Looking ahead, HATCH WORK is pursuing a multi-phase strategy focused on: (1) expanding registered parking lots; (2) utilizing mobility and property data for predictive analytics and personalized service delivery; and (3) redefining parking lots as “First One Mile Stations”—mobility hubs that serve as platforms for disaster response and smart urban services. Through these initiatives, the company aims to position monthly parking as a central asset in future smart cities.

| Company Name | Hatch Work Co.,Ltd. |

| Headquarters | DF Building, 2-2-8 Minami-Aoyama, Minato-ku, Tokyo |

| Website | https://hatchwork.co.jp/ |

| Year of Establishment | 2000/6/26 |

| Listing Date | 2024/3/26 |

| Industry | Information and communication industry |

| Business Overview | ・”At Parking”, a portal site for searching and booking monthly parking spaces, and ・”At Parking Cloud”, an online management system that helps parking lot owners and operators manage monthly parking contracts. |

| Representative (CEO) | Tomohei Masuda |

| Number of Employees | 67 (as of 2024/1/31) |

| Stock Exchange | Tokyo Stock Exchange Growth |

| Auditor | Miogi |

| Lead Underwriter | SMBC Nikko Securities |

| Market capitalization (at opening price) | 5,117 million yen |

| PER (at opening price) | -12.47 |

| Major shareholders (Top 3) | •Otake And Partners Corporation (25.27%) •Dynaegg Corporation (15.03%) •Hiroshi Otake (11.49%) |

This document has been prepared based on information available at the time of the research. While we strive for accuracy, we do not guarantee the completeness or correctness of the information provided. This document is for informational purposes only and does not constitute investment advice or a recommendation. Readers are encouraged to conduct their own verification and due diligence before making any decisions.

Source: Tokyo IPO, Official Website, Yahoo! Finance