This article introduces recently IPO-listed companies in Japan while highlighting key challenges, business opportunities, industry trends, and unique business models in the Japanese market.

JSH Co., Ltd., headquartered in Tokyo, Japan, is a social impact-driven company focused on expanding access to home medical care and promoting inclusive employment in regional communities. Since its founding in 2016, JSH has aimed to support people with mental health conditions and disabilities by offering community-based healthcare services and employment platforms that foster stability, autonomy, and social participation.

JSH operates two core businesses:

In Japan’s aging society, where psychiatric hospitalization remains high and rural employment options are limited, JSH’s model bridges gaps in medical access and inclusive employment. Its home medical service supports psychiatric clinics with consulting and care coordination, while its farms allow companies to meet disability hiring obligations through structured, nurse-supported job placements in accessible environments.

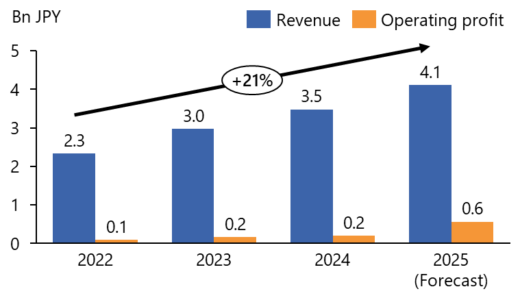

As of FY2024 (ended March 31, 2024), JSH reported consolidated revenue of ¥3.48 billion, a 17.3% increase year-over-year. Operating profit rose 26.5% to ¥208 million. Its recurring-revenue business model is reflected in a 90% subscription rate within the employment support segment, with Annual Recurring Revenue (ARR) exceeding ¥2.07 billion (+34.9% YoY). Net Revenue Retention stood at 113%, driven by strong client retention and upselling.

Cordiale Farms are currently operating across 17 sites in southern Japan, with a total capacity to employ over 1,100 persons with disabilities. The average one-year workplace retention rate for mental health disability workers at the farms is 76%, well above the national average of 49%.

For FY2025, JSH projects revenue of ¥4.11 billion (+18.1% YoY) and operating profit of ¥258 million (+24.2%). Growth will be supported by new farm openings, further partnerships with local medical institutions, and rising demand in response to national disability employment rate increases (from 2.3% to 2.7% by 2026).

Looking forward, JSH is committed to expanding its impact through a hybrid model of healthcare and employment services tailored to regional needs. By leveraging its psychiatric care expertise and inclusive employment platform, the company aims to support sustainable communities where all individuals can thrive regardless of location or background.

| Company Name | JSH Corporation |

| Headquarters | Central Building 1-1-5 Kyobashi, Chuo-ku, Tokyo |

| Website | https://www.jsh-japan.jp/ |

| Year of Establishment | 2016/4/4 |

| Listing Date | 2024/3/26 |

| Industry | Service industry |

| Business Overview | ・Regional Revitalization Initiatives: Support for employment of persons with disabilities and tourism/local specialty product services ・Home-Based Medical Care Services: Psychiatric home-visit consulting and home nursing care |

| Representative (CEO) | Kazuki Noguchi |

| Number of Employees | 423 (as of 2024/1/31) |

| Stock Exchange | Tokyo Stock Exchange Growth |

| Auditor | KPMG Azusa |

| Lead Underwriter | SBI Securities |

| Market capitalization (at opening price) | 4,896 million yen |

| PER (at opening price) | 21.65 |

| Major shareholders (Top 3) | •Kazuki Noguchi (39.63%) •JAFCO SV5 Shared Investment Limited Partnership (31.51%) •JAFCO SV5 Star Investment Limited Partnership (7.79%) |

This document has been prepared based on information available at the time of the research. While we strive for accuracy, we do not guarantee the completeness or correctness of the information provided. This document is for informational purposes only and does not constitute investment advice or a recommendation. Readers are encouraged to conduct their own verification and due diligence before making any decisions.

Source: Tokyo IPO, Official Website, Yahoo! Finance